ARTICLE AD BOX

We may earn from vendors via affiliate links or sponsorships. This might affect product placement on our site, but not the content of our reviews. See our Terms of Use for details.

What do Starbucks, Home Depot, Burger King, and Tesla have in common? They all accept cryptocurrency payments.

Cryptocurrencies are no longer confined to the realm of tech enthusiasts — they’ve become a practical payment option for businesses of all sizes. In the U.S. alone, more than 2,000 businesses now accept cryptocurrency payments, with major brands like Starbucks, Home Depot, and Tesla leading the charge.

For tech-savvy business owners and entrepreneurs, accepting crypto payments can open doors to a broader customer base, reduce transaction costs, and strengthen payment security. However, diving into this new world of payments comes with its own set of considerations and challenges.

- Crypto payments offer global accessibility and reduced transaction fees, making them an attractive option for businesses looking to expand internationally or cut costs.

- Adopting crypto payments requires careful preparation, including setting up wallets, integrating payment processors, and addressing legal and tax obligations.

- While crypto offers benefits like faster payments and enhanced security, businesses must navigate challenges like price volatility, regulatory uncertainty, and complex tax implications.

This guide will walk you through the essential steps to accept crypto payments confidently and seamlessly in your business.

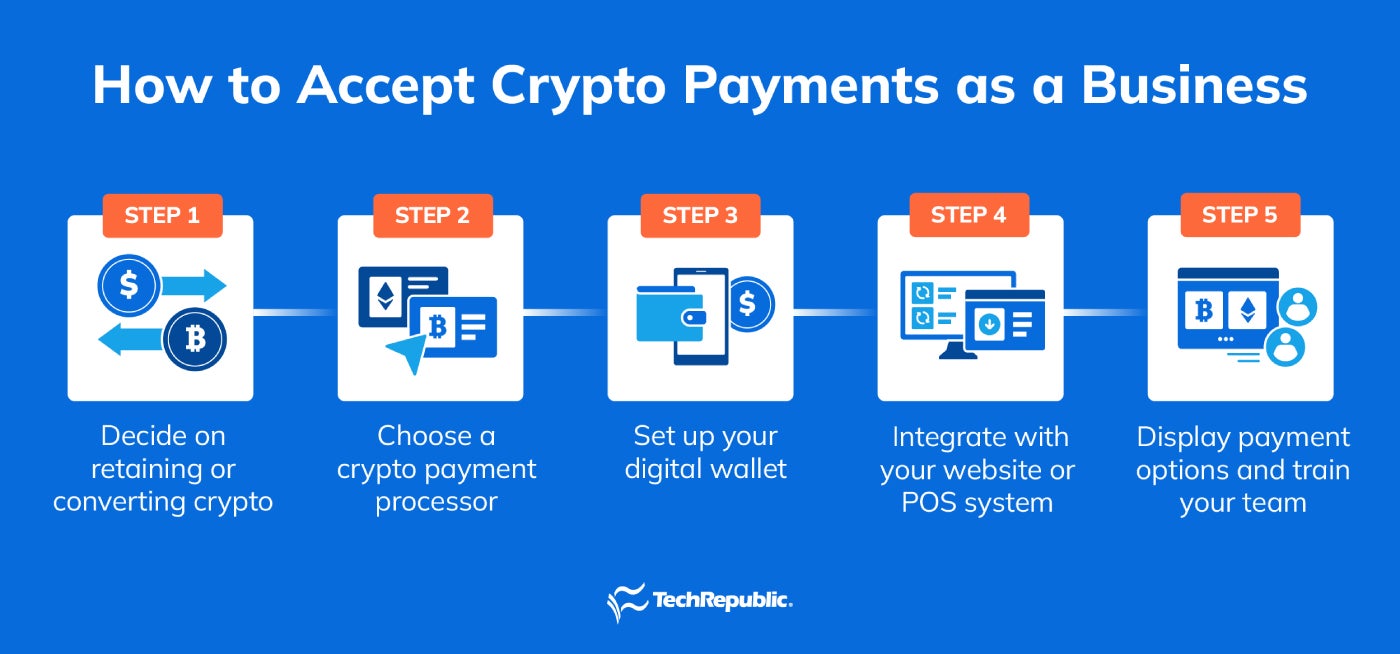

How to accept crypto payments as a business

Accepting crypto payments can be straightforward when broken down into a few clear steps. Here’s how you can get started.

-

Decide on retaining or converting crypto

Before you begin, decide how you want to handle the cryptocurrency you receive:

- Retain crypto: Keeping payments in cryptocurrency can serve as an investment opportunity but carries the risk of price volatility. You’ll need a secure digital wallet and potentially a plan for managing tax implications.

- Convert to fiat: Automatically converting crypto into fiat currency (e.g., USD, EUR) ensures stability and simplifies accounting. Many crypto payment processors offer automatic conversion features.

When making this decision, consider your business goals, risk tolerance, and local regulations. This choice will also guide your selection of a payment processor.

-

Choose a crypto payment processor

A crypto payment processor simplifies transactions and integrates crypto payments with your existing systems. Popular options include BitPay, Coinbase Commerce, and NOWPayments. For other options, check our list of the best crypto payment gateways.

When choosing a processor, evaluate these features:

- Supported cryptocurrencies: Ensure it supports the coins you want to accept (e.g., Bitcoin, Ethereum, USDT).

- Integration options: Check for plugins or APIs for seamless integration with platforms like Shopify, WooCommerce, or custom systems.

- Fees: Compare transaction fees, withdrawal fees, and other associated costs.

- Developer tools: Look for detailed API documentation, SDKs, and developer support for custom integrations.

-

Set up your digital wallet

A digital wallet is essential for receiving and storing cryptocurrency. There are two primary options:

- Custodial wallets: These are wallets managed by third parties (e.g., Coinbase, Binance). Custodial wallets are user-friendly and secure but rely on the service provider for private key management. Most web wallets are custodial wallets.

- Non-custodial wallets: These wallets provide full control of private keys (e.g., Ledger, MetaMask) and are ideal for businesses prioritizing security but require technical knowledge to set up and manage. Non-custodial wallets may be hot or cold–hot wallets, which are connected to the internet, making them more accessible, or cold wallets, which are stored offline, making them more secure. Some options for hot wallets are desktop wallets, mobile wallets, and web wallets. For cold wallets, the go-to option is hardware wallets.

For maximum security, consider hardware wallets for offline storage of crypto assets.

-

Integrate with your website or POS system

Integrating crypto payment options ensures a seamless transaction experience for your customers, whether online or in-store.

- For e-commerce: Most crypto payment processors offer plugins for platforms like WooCommerce, Magento, and Shopify. For custom setups, use APIs to integrate directly with your website’s backend.

- For physical stores: Use QR codes to allow customers to scan and pay directly to your wallet or processor. Many POS systems now offer crypto support or can be upgraded with add-ons like Clover’s Crypto Integration or Shopify POS for physical stores.

-

Display payment options and train your team

Clearly display that you accept crypto payments on your website or physical store to inform customers. Ensure your team is trained on how to process these transactions, handle customer questions, and troubleshoot common issues.

- Visibility: Prominently showcase crypto payment options on your website, checkout pages, and physical store signage. For example, Add a “Pay with Crypto” button on your website.

- Team training: Train staff to manage crypto transactions, verify payment confirmations on the blockchain, and address customer inquiries. Ensure they can resolve issues like incorrect amounts sent or delayed confirmations.

Benefits of accepting crypto payments

Accepting cryptocurrency as a payment method can provide numerous advantages for businesses. Here are the key benefits.

- Lower transaction fees: Crypto transactions often have significantly lower processing fees than credit cards or traditional payment systems, saving your business money, especially for high-volume or international transactions. While card transactions can cost around 2% to 4% per transaction, crypto transactions can be as low as 0% to 2% per transaction.

- Faster payments: Unlike traditional banking systems, crypto payments are processed almost instantly, regardless of the sender’s or recipient’s location. This can improve cash flow and reduce delays in receiving funds.

- Global accessibility: Cryptocurrency will enable your business to accept payments from customers worldwide without dealing with exchange rates or international transfer fees; this is particularly advantageous for e-commerce and global enterprises. However, remember there are still a few countries like China where cryptocurrencies are illegal.

- Fraud protection: Blockchain technology ensures that crypto transactions are secure, irreversible, and transparent. This reduces the risk of chargebacks and fraud, offering businesses peace of mind.

- Attracting tech-savvy customers: Accepting crypto can differentiate your business and appeal to a growing demographic of tech-savvy customers who prefer alternative payment methods in an increasingly cashless society.

- Future-proofing your business: As cryptocurrency adoption continues to grow, integrating it into your payment options positions your business at the forefront of innovation, ready to adapt to emerging trends in digital finance.

Drawbacks of accepting crypto payments

While accepting cryptocurrency offers advantages, it’s important to consider the potential drawbacks.

- Price volatility: Cryptocurrency prices can fluctuate significantly within short periods. This volatility poses a risk for businesses holding crypto, as the payment value can decrease before conversion to fiat currency.

- Regulatory uncertainty: Cryptocurrencies are subject to evolving legal and regulatory frameworks that vary by country. Businesses accepting crypto must stay updated on compliance requirements, reporting obligations, and tax implications.

- Limited customer base: Despite growing adoption, the number of customers preferring to pay with crypto remains relatively small, especially outside tech-savvy or niche markets. This limits its widespread applicability for many businesses.

- Complex setup and maintenance: Integrating crypto payments requires technical knowledge and resources, including choosing the right processor, setting up wallets, and ensuring secure storage. Businesses also need to update systems regularly to maintain compatibility and security.

- Transaction costs for conversions: While crypto transactions often have low processing fees, converting cryptocurrency to fiat typically incurs additional charges such as a “gas fee.” These conversion fees can erode some of the cost savings.

Tax and legal considerations for accepting crypto payments

Accepting cryptocurrency payments introduces specific tax and legal obligations you must address for your business to remain compliant. Here’s what to keep in mind.

Tax implications

Cryptocurrency transactions are taxable in many jurisdictions. The specific rules vary, but common requirements include:

- Income reporting: Cryptocurrency received as payment is considered taxable income, usually based on its fair market value at the time of the transaction.

- Capital gains tax: If you retain crypto and later sell or exchange it, you may incur capital gains or losses depending on its change in value.

- Sales tax: In some regions, businesses must collect and remit sales tax on goods or services sold via crypto, just as with traditional payments.

Maintain detailed records of all transactions, including the date, value at the time of receipt, and any subsequent conversion details, to simplify tax reporting. Consider tools like CoinTracking or CryptoTrader.tax for managing tax reporting.

Regulatory compliance

Accepting crypto payments also entails ensuring compliance with regulatory requirements. Different governments and regulatory bodies have varying rules for cryptocurrency use:

- Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations: Some jurisdictions require businesses to comply with KYC and AML laws when accepting crypto, particularly for large transactions.

- Licensing requirements: Certain regions may require a license to conduct cryptocurrency transactions or use specific payment processors.

- Cryptocurrency Security Standard: Companies that use, store, and accept cryptocurrencies must follow a set of requirements similar to the Payment Card Industry Data Security Standard (PCI DSS). If you also accept card payments, you will need to maintain PCI compliance and CSS compliance.

Consult local regulatory guidelines to ensure compliance and avoid penalties.

Recordkeeping

Accurate documentation is critical for tax and legal purposes. Use tools or software to track crypto transactions, including wallet addresses, transaction IDs, and fiat conversions. Many crypto payment processors offer built-in reporting features to help with recordkeeping and compliance.

International transactions

Cryptocurrency is borderless, but international payments may trigger additional considerations.

- Export/import laws: Verify that crypto payments comply with international trade regulations in the countries where you do business.

- Foreign exchange rules: Be aware of any currency control regulations that could impact crypto conversions.

Legal uncertainty

Cryptocurrency regulations are evolving. To ensure ongoing compliance, stay informed about changes in laws and guidelines in your operating regions. Also, regularly consult with legal and tax professionals who specialize in cryptocurrency.

Examples of businesses successfully accepting crypto payments

Cryptocurrency is no longer a niche payment method, with numerous businesses across industries embracing it. Here are notable examples.

- Overstock: This popular online store became the first major retailer to accept Bitcoin in 2014, setting a precedent for large-scale crypto adoption in ecommerce. The company remains a leader in accepting multiple cryptocurrencies today; currently, it accepts all kinds of cryptocurrencies.

- Printemps: This iconic French department store chain made headlines as the first in Europe to accept cryptocurrency payments. Customers need to have the Binance app, and they can choose to pay using any cryptocurrency on the platform.

- Subway: This global fast-food restaurant chain was one of the earliest adopters of Bitcoin in 2013, enabling customers to buy sandwiches with crypto at select locations. This move showcased the potential of digital currencies in the food and beverage industry.

- Starbucks: As one of the largest global chains to accept cryptocurrency, Starbucks integrates crypto payments in the U.S.

- Crypto Real Estate: This real estate marketplace facilitates property purchases worldwide using cryptocurrency. From luxury homes to commercial properties, Crypto Real Estate demonstrates how crypto can streamline high-value transactions.

Frequently Asked Questions (FAQs)

Read the answers to common questions on how to accept crypto payments.

What is crypto?

Cryptocurrency, often simply called crypto, is a form of digital currency secured by cryptography and powered by blockchain technology, a decentralized ledger maintained by a global network of computers. Unlike traditional money issued by governments (fiat currency), cryptocurrencies operate independently of any central authority.

Bitcoin, the first and most well-known cryptocurrency, paved the way for thousands of others, including Ethereum, Litecoin, and stablecoins like USDT. These currencies enable peer-to-peer transactions, often with lower fees and faster processing times than traditional payment methods. This combination of decentralization, security, and efficiency makes cryptocurrency an attractive payment option for modern businesses.

Which crypto is the most accepted today?

Bitcoin is the most widely accepted cryptocurrency due to its first-mover advantage and global recognition. Many businesses also accept Ethereum, Litecoin, and stablecoins like USDT and USDC for their reliability and lower volatility.

Where is Bitcoin accepted today?

Bitcoin is accepted by various businesses, including major retailers like Overstock, restaurants such as Subway, and global chains like Starbucks. It’s also commonly used for online services, donations, and even real estate transactions.

How can I accept Bitcoin payments?

To accept Bitcoin payments, set up a Bitcoin wallet and choose a crypto payment processor to handle transactions. Integrate the processor into your website or POS system to enable seamless customer payments.

How secure are crypto payments for businesses?

Crypto payments are highly secure due to blockchain’s immutable nature, but businesses must use multi-signature wallets and robust cybersecurity protocols to prevent hacking or fraud.

What are Layer 2 solutions, and why are they important for crypto payments?

Layer 2 solutions, like Bitcoin’s Lightning Network or Ethereum’s Optimism, improve transaction speed and reduce costs by processing payments off the main blockchain.

2 days ago

6

2 days ago

6

English (US)

English (US)